Sustainable Financing and Investor demands

Sustainability, ESG, and climate change considerations are no longer optional in real estate project financing. They have become critical aspects that can significantly influence a project’s financial viability, investment attractiveness, and long-term sustainability. Furthermore, the paper emphasizes that embracing these principles can lead to numerous opportunities such as increased investor demand, regulatory compliance, and long-term value creation while mitigating climate-related risks. Thus, the integration of these aspects into project financing strategies is a pivotal step towards achieving the UAE’s sustainability goals and enhancing the resilience of its real estate industry in the face of climate change.

Investor demand for sustainable and ESG-compliant projects is rising in the UAE. Asset managers and institutional investors are increasingly integrating ESG factors into their investment processes, reflecting their stakeholders’ growing demand for responsible investment. Real estate projects that fail to meet these expectations face the risk of reduced financing options and potential divestments.

Sustainable finance is sure to become mainstream financing; a crucial component in project financing worldwide, including the UAE.

Investors are integrating environmental, social, and governance (ESG) criteria into the business or investment decisions.

In the context of real estate, it implies ensuring project development aligns with ESG considerations to minimize adverse environmental impact and promote social well-being. Green bonds and loans, along with impact investing, are becoming popular financial tools to fund sustainable real estate projects.

The UAE’s real estate sector has always played a game of love and betrayal with the country, being both generous and loyal to its real estate. However, in the year 2023, which the UAE has declared as “The Year of Sustainability” under the banner of “Today for Tomorrow,” it seems that the sun has set on any schisms between the two, and the time of their final union is at hand.

Like any good story, several characters have played their roles. There are two major trends in the UAE’s real estate market sector, both having a profound impact on the outlook, social, and economic priorities – from individuals to the country at large:

- The unprecedented, perhaps too good to be true, soaring real estate market in 2023.

- The elevated responsibility to combat the soaring carbon footprint of this surging real estate sector.

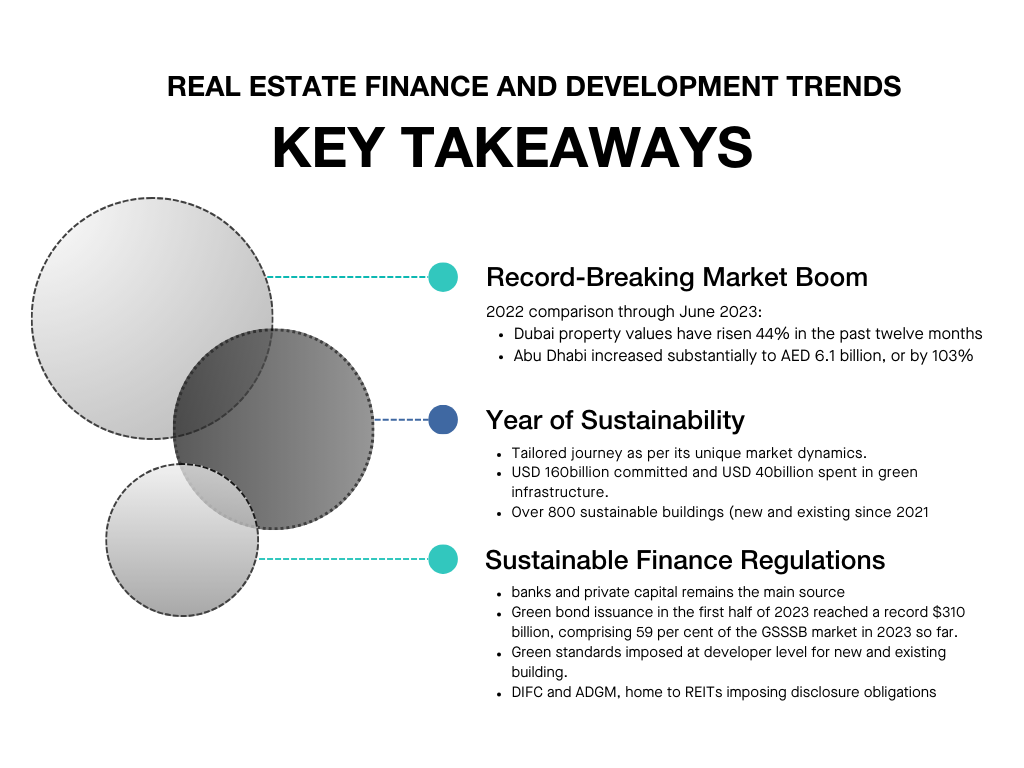

The Trends: Record-breaking Rise

It is estimated that Abu Dhabi recorded 10,557 real estate transactions worth Dh46.33 billion in the first half of 2023 due to an upward trend in buyer demand.

According to the Abu Dhabi media office, citing data from the Department of Municipalities and Transport, the value of the deals more than doubled during the six-month period, while the volume of transactions grew by 41% annually.

Residential property sales in Dubai also experienced a significant surge in the first half of 2023, generating approximately $28 billion (AED 93.18 billion) in revenue. Notably, the number of units sold during this period experienced a remarkable spike of 35.25%, totaling 46,835 units, representing a 46.71% increase over the previous year. Sales values in commercial real estate were also up 30%, indicating robust growth.

Another study by CBRE showed that average residential prices in Dubai grew by 15.9% in the year through May 2023, with average apartment prices increasing by 15.9% and average villa prices by 16.0% over the same period.

Abu Dhabi’s wealth fund ADQ and International Holding Co. are combining their shareholdings in Modon Properties and ADQ’s stake in Abu Dhabi National Exhibitions Co. into a single real estate firm called “Q Holding,” creating a $12 billion property giant with a portfolio of real estate developments, venues, land plots, and hospitality assets.

Trends Behind the Boom: Influx of Foreign Funds

A significant influx of Chinese investors has been coming to the UAE in recent years, driving the UAE’s real estate market forward.

In early 2023, Chinese travel restrictions were lifted, enabling Chinese investors to access Dubai’s property market. This came after China reopened its borders following the COVID-19 pandemic, while China’s property crisis prompted investors to seek safe havens for their capital globally.

According to Emaar Properties, Dubai’s largest developer, Chinese investments in its projects nearly doubled to account for 7% of total sales in the first half of 2023, up from approximately 3% to 4% in the same period a year earlier.

Russian investors also heavily finance the UAE real estate boom. The outbreak of the Russia-Ukraine war and the EU’s ban on Russian transactions have led to Russian investment becoming a major source of financing in the UAE real estate market, causing property prices to increase by 47%.

Trends: The Year of Sustainability

While the real estate boom is beneficial for the economy, its timing could have been better. The record-breaking rise in the price and value and value or real estate transactions, and the Conference of Parties 28 (COP28) fast approaching, in less than 8 weeks, the pressure to accelerate the race speed towards Net Zero has quadrupled, becoming the most significant trend and development of this time.

Real Estate has one of the highest carbon footprints contributing 30% of global annual greenhouse gas (GHG) emissions and consumes around 40% of the world’s energy[1].

[1] 2019 global status report for buildings and construction, International Energy Agency, December 2019.