Introduction to ESG Standards and Frameworks

Environmental, Social, and Governance (ESG) criteria have become central to contemporary corporate strategy, reflecting the growing recognition of sustainability and corporate responsibility’s role in long-term success. ESG standards and frameworks provide the methodologies by which organizations can measure, manage, and communicate their activities in these areas. While both tools aim to guide companies in their ESG efforts, they serve different but complementary purposes.

ESG Standards

ESG standards are specific, consistent guidelines that organizations can apply to measure and report on their sustainability performance. These standards offer a set of metrics for quantifying an organization’s impact on environmental sustainability, social responsibility, and governance practices. By adhering to ESG standards, companies ensure their disclosures are comparable, reliable, and transparent, facilitating stakeholders in assessing the entity’s ESG performance effectively.

ESG Frameworks

In contrast, ESG frameworks provide a broader structure for reporting, focusing on the principles and strategies organizations should adopt to disclose their ESG activities. These frameworks often encompass guidelines on what information should be reported, rather than prescribing specific metrics. They offer flexibility, allowing companies to tailor their reporting to reflect their unique circumstances and sustainability priorities.

Types of reporting and Disclosure

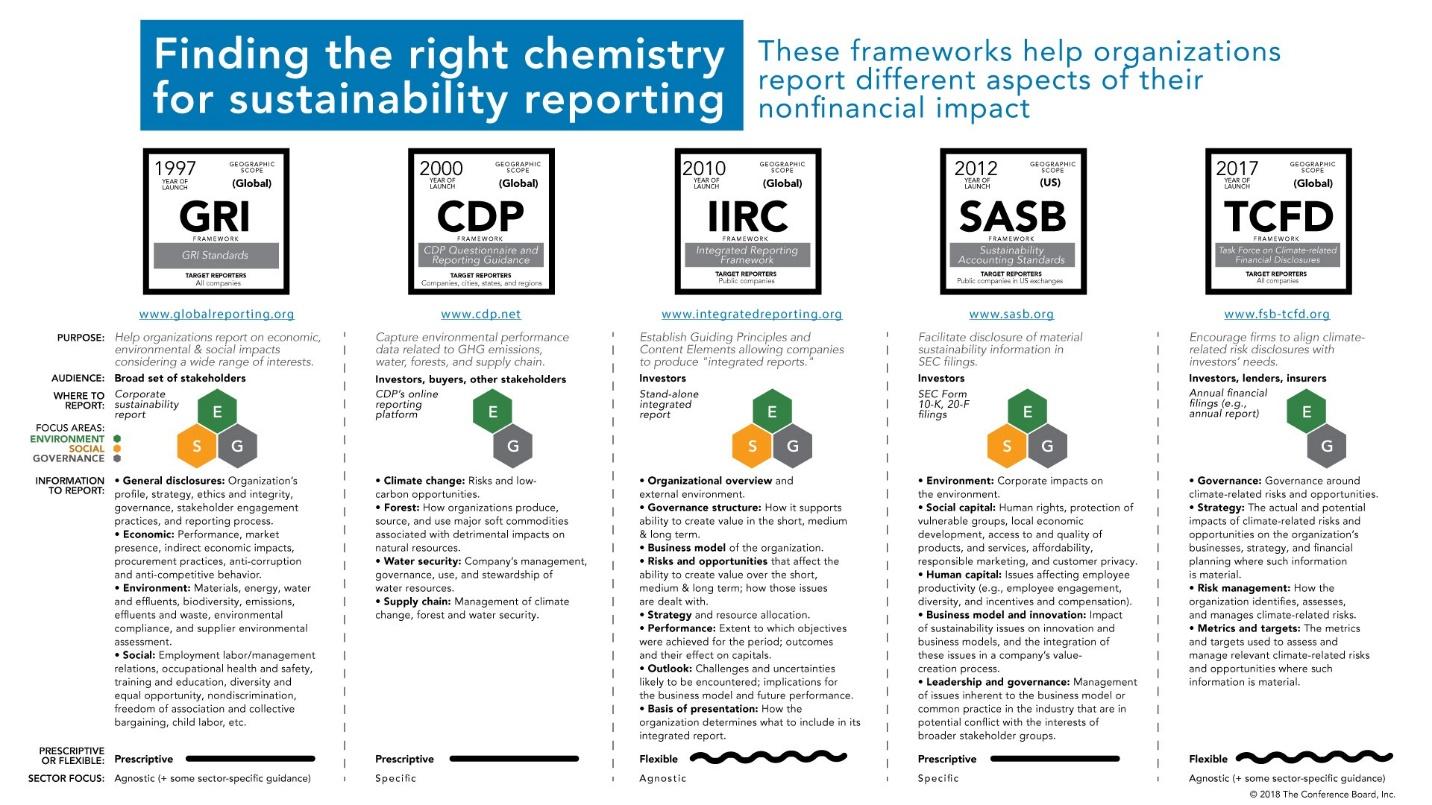

The landscape of ESG reporting is diverse, with multiple standards and frameworks coexisting, each catering to different aspects of sustainability reporting. Prominent among these are:

- Global Reporting Initiative (GRI): A widely used framework that offers a comprehensive set of principles and indicators for economic, environmental, and social performance.

- Sustainability Accounting Standards Board (SASB): Provides industry-specific standards that focus on financially material sustainability information relevant to investors.

- Task Force on Climate-related Financial Disclosures (TCFD): Offers recommendations for disclosing climate-related financial risks and opportunities.

- CDP (formerly the Carbon Disclosure Project): Facilitates disclosure of environmental impact data, including greenhouse gas emissions and water usage.

These tools vary in their focus, with some emphasizing investor-relevant data (SASB, TCFD) and others broader stakeholder engagement (GRI, CDP). Compliance with these standards and frameworks often depends on regulatory requirements, investor pressure, or voluntary commitment to sustainability principles.

Choosing the Right Standards or Framework

Selecting the appropriate ESG standard or framework is crucial and should be tailored to the organization’s specific needs, characteristics, and stakeholder expectations. Factors to consider include:

Size of the Company

Larger organizations with more complex operations might benefit from comprehensive frameworks like GRI, which can accommodate a wide range of activities and impacts. In contrast, smaller companies may prioritize materiality, opting for SASB’s industry-specific standards to focus on the most critical issues.

Market Sector

The relevance of certain ESG issues varies significantly by industry. Companies in the energy sector, for example, might prioritize frameworks that emphasize environmental metrics and climate-related financial disclosures (TCFD), reflecting the high materiality of these issues in their operations.

Stakeholder Expectations

Understanding the needs and preferences of key stakeholders (investors, customers, regulators) is critical. For instance, a company with a strong investor focus might lean towards SASB and TCFD, which emphasize financial materiality and risk management.

“In a world where investment decisions are increasingly driven by non-financial factors, clear and standardized ESG disclosures are not optional, but essential. It’s the transparency that builds trust and value.”

Mark Carney, Former Governor of the Bank of England Tweet

Getting Started

Initiating an ESG reporting journey involves several key steps:

- Materiality Assessment: Identify the most significant ESG issues impacting the business and its stakeholders. This helps prioritize reporting efforts.

- Benchmarking: Evaluate current practices against industry peers and standards to identify gaps and opportunities for improvement.

- Stakeholder Engagement: Involve key stakeholders in the process to ensure the reporting addresses their concerns and interests.

- Selecting Standards/Frameworks: Based on the above steps, choose the standards or frameworks that best align with the company’s priorities and stakeholder expectations.

- Implementation: Develop a plan for data collection, analysis, and reporting. This may involve cross-functional teams to ensure comprehensive coverage of all relevant ESG issues.

- Continuous Improvement: ESG reporting is an ongoing process. Regular review and updates to the reporting approach are essential to reflect changes in the business, industry standards, and stakeholder expectations.

Navigating the ESG reporting landscape requires a strategic approach, tailored to an organization’s specific context and stakeholder needs. By understanding the differences between ESG standards and frameworks, and carefully selecting and implementing the appropriate tools, companies can enhance their sustainability performance, build stakeholder trust, and contribute to a more sustainable future.